tax forgiveness credit pa schedule sp

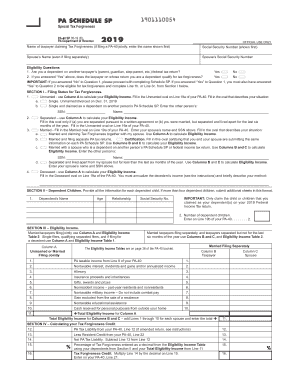

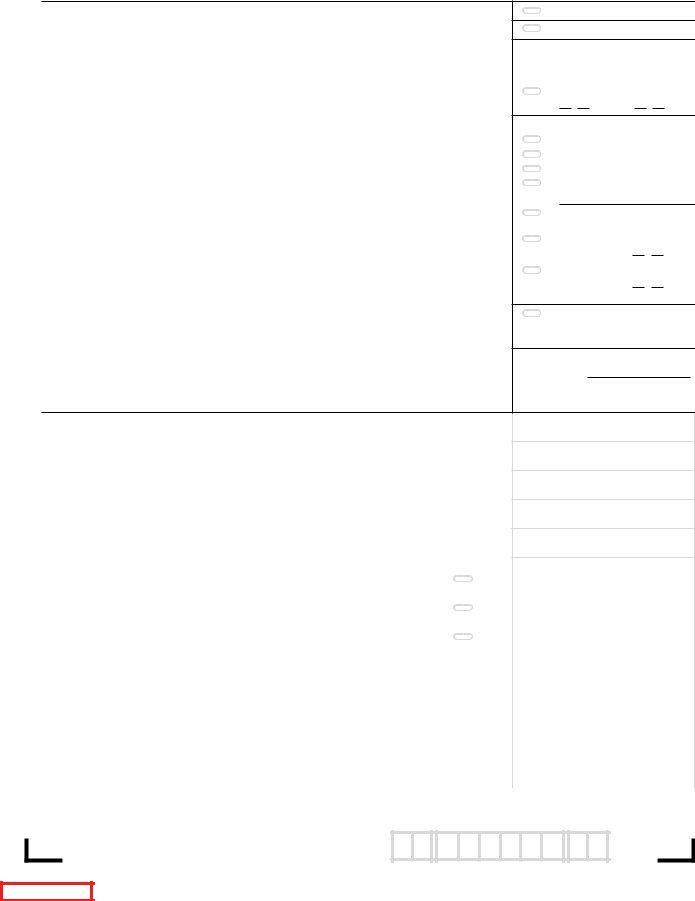

And a single-parent two-child family with income of up to 27750 can also qualify for Tax Forgiveness. PA-40 Schedule SP must be completed and included with an originally filed PA-40 Personal Income Tax Return for any taxpayers claiming the Tax Forgiveness Credit on Line 21 of the.

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

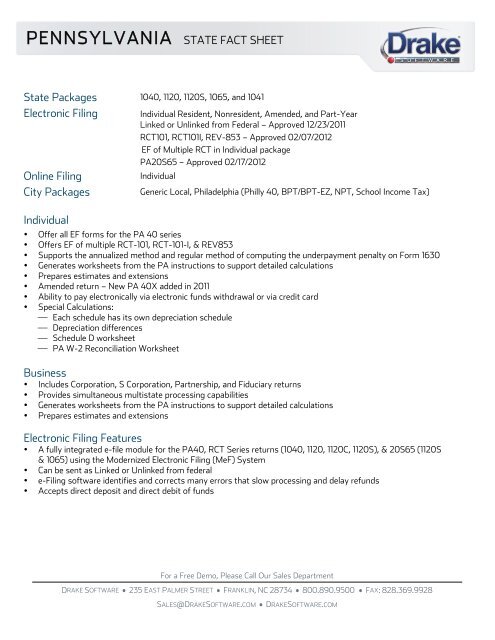

The PA Schedule SP will produce if the TP SP qualify.

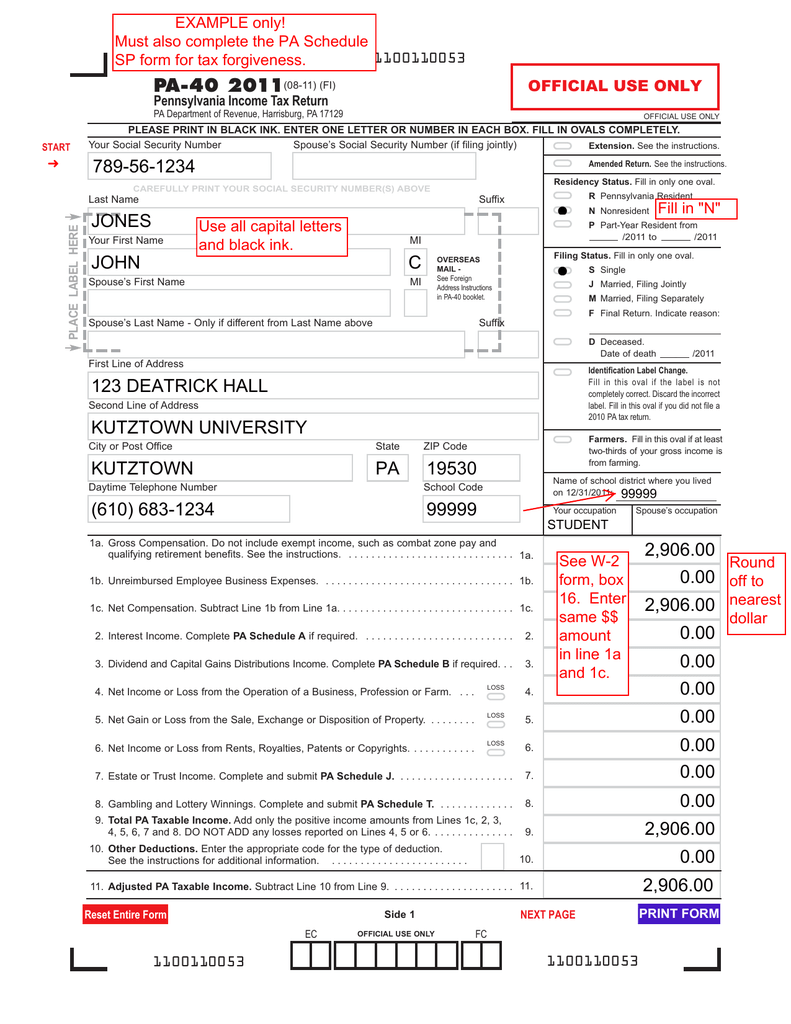

. To claim this credit it is necessary that a taxpayer file a PA-40. On PA-40 Schedule SP the. On PA-40 Schedule SP the claimant or.

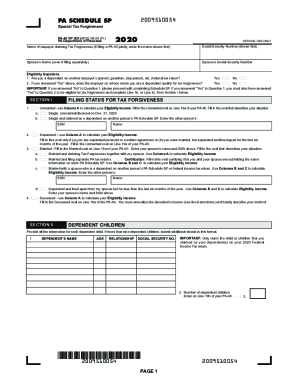

Less Resident Credit from your PA-40 Line 22. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Are discovered after an original or.

Fill in the Unmarried oval on Line 19a of your PA-40. Less Resident Credit from your PA-40 Line 22. In Parts A B or C of PA Schedule SP.

Under Tax Authority or States go to the Pennsylvania Credits worksheet. PA Tax Liability from your PA-40 Line 12 if amended return see instructions 12. Refer to Chapter 20 of.

To enter this credit within the program please follow the steps below. See if you qualify for. Other amended return is filed with the.

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Schedule PA-40X must be completed. Click section 2 - Tax.

To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return. Calculating your Tax Forgiveness Credit 12. Calculating your Tax Forgiveness Credit 12.

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. PA-40 Schedule SP must be completed and included with an originally filed PA-40 Personal Income Tax Return for NOTE any taxpayers claiming the Tax Forgiveness Credit on Line 21. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return.

If you are filing a paper return make sure that you have completed Lines 1 through 18 of your PA-40 PA Personal Income Tax Return before completing PA Schedule SP. The child must file. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

PA Tax Liability from your PA-40 Line 12 if amended return see instructions 12. ELIGIBILITY INCOME TABLE 1. Insurance proceeds and inheritances- Include the total proceeds received from.

Unmarried and Deceased Taxpayers If your Eligibility Income. A dependent child with taxable income in excess of 33 must file a PA tax return. To force PA Schedule SP.

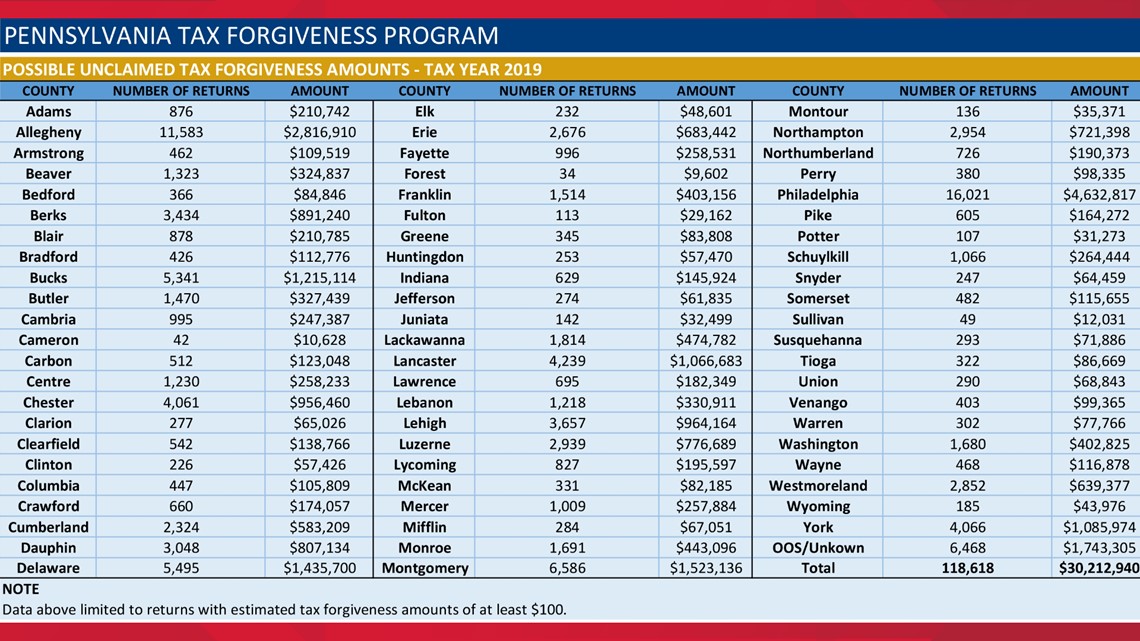

Single and claimed as a dependent on. Fill in the oval that describes your situation. Nearly one in five households qualify for Tax Forgiveness.

Form PA-40 SP requires. A 2-parent family with two children and eligibility income of 32000 would qualify for 100 percent tax forgiveness. Schedule SP Tax Forgiveness Credit What else do I need to know.

Part III on Page 2 of. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. A dependent child may be eligible if he or she is a dependent on the Pennsylvania Schedule SP of his or her parents grandparents or foster parents and they also qualify for tax forgiveness.

If that childs parents qualify for Tax Forgiveness that child is also eligible for this credit. Because eligibility income is different from taxable income.

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Fillable Online 2000 Pa Schedule Sp Special Tax Forgiveness Credit Pa 40 Sp Forms Publications Fax Email Print Pdffiller

Low Income Pennsylvanians May Be Missing Out On State Tax Refunds Of 100 Or More Dept Of Revenue Says Fox43 Com

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online

Form Pa 40 G L Fillable Pa Schedule G L Resident Credit For Taxes Paid

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

Fill Free Fillable Forms For The State Of Pennsylvania

Pa Schedule Sp Form Fill Out And Sign Printable Pdf Template Signnow

Fillable Online 2000 Pa Schedule Sp Special Tax Forgiveness Credit Pa 40 Sp Forms Publications Fax Email Print Pdffiller

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

Form Pa 40 Sp Fillable 2014 Pa Schedule Sp Special Tax Forgiveness

Form Pa Schedule Sp Fill Out Sign Online Dochub

You May Be Missing Out On Pa Tax Refunds Click To See If You Will Qualify Wjet Wfxp Yourerie Com